When Reviewing the Net Present Value Profile for a Project

What is Internet Present Value (NPV)?

Net Present Value (NPV) is the value of all future greenbacks flows (positive and negative) over the entire life of an investment discounted to the present. NPV assay is a form of intrinsic valuation and is used extensively across finance and bookkeeping for determining the value of a business, investment security, capital project, new venture, price reduction program, and anything that involves cash catamenia.

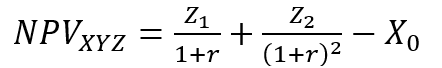

NPV Formula

The formula for Net Present Value is:

Where:

- Z 1 = Cash flow in time ane

- Z 2= Greenbacks flow in fourth dimension 2

- r = Discount rate

- 10 0 = Cash outflow in time 0 (i.e. the purchase price / initial investment)

Why is Internet Present Value (NPV) Assay Used?

NPV analysis is used to aid determine how much an investment, project, or any series of cash flows is worth. It is an extensive metric, as it takes into account all revenues , expenses, and capital costs associated with an investment in its Free Cash Flow (FCF) .

In add-on to factoring all revenues and costs, it also takes into account the timing of each greenbacks flow that can issue in a large impact on the present value of an investment. For case, it's ameliorate to see cash inflows sooner and cash outflows later, compared to the opposite.

Why Are Cash Flows Discounted?

The cash flows in internet present value analysis are discounted for two main reasons, (one) to adapt for the run a risk of an investment opportunity, and (2) to account for the time value of coin (TVM).

The start signal (to arrange for take chances) is necessary because not all businesses, projects, or investment opportunities take the aforementioned level of gamble. Put another manner, the probability of receiving cash menstruation from a United states of america Treasury bill is much higher than the probability of receiving cash flow from a immature technology startup.

To account for the gamble, the discount rate is higher for riskier investments and lower for a safer one. The US treasury example is considered to exist the risk-free rate, and all other investments are measured by how much more than risk they bear relative to that.

The 2nd signal (to account for the time value of money) is required because due to aggrandizement, interest rates, and opportunity costs, money is more valuable the sooner it'south received. For case, receiving $1 meg today is much ameliorate than the $ane million received 5 years from now. If the coin is received today, it can exist invested and earn interest, so information technology volition be worth more $1 million in five years' fourth dimension.

Example of Net Present Value (NPV)

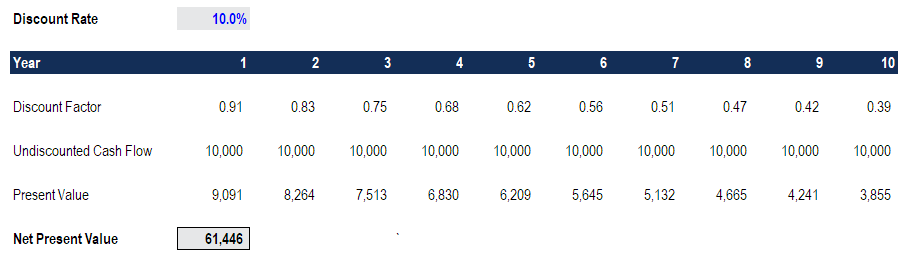

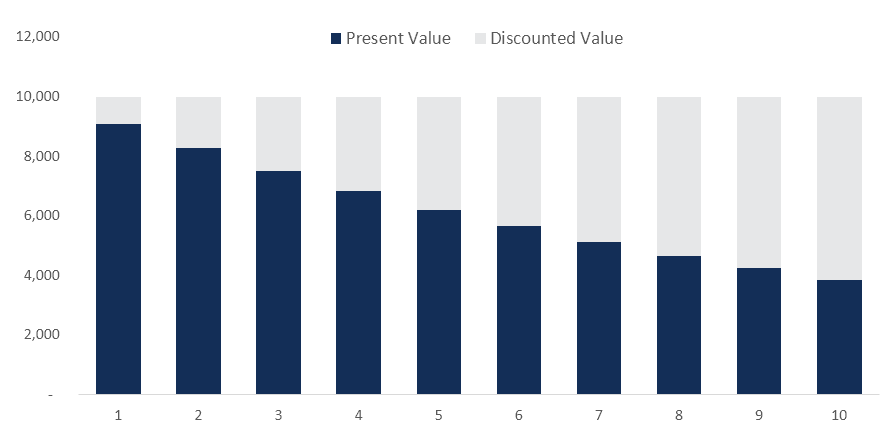

Let'southward look at an example of how to calculate the net present value of a series of cash flows . As you tin can see in the screenshot below, the assumption is that an investment volition return $10,000 per year over a catamenia of ten years, and the discount rate required is 10%.

The final result is that the value of this investment is worth $61,446 today. Information technology means a rational investor would be willing to pay upward to $61,466 today to receive $ten,000 every year over 10 years. By paying this price, the investor would receive an internal rate of render (IRR) of 10%. Past paying annihilation less than $61,000, the investor would earn an internal rate of render that's greater than x%.

Download the Free Template

Enter your proper noun and email in the form beneath and download the free template now!

Net Nowadays Value Template

Download the free Excel template now to advance your finance knowledge!

NPV Functions in Excel

Excel offers 2 functions for computing net present value: NPV and XNPV. The two functions employ the same math formula shown to a higher place but save an analyst the time for calculating it in long form.

The regular NPV office =NPV() assumes that all cash flows in a serial occur at regular intervals (i.e., years, quarters, month) and doesn't allow for any variability in those fourth dimension periods.

The XNPV office =XNPV() allows for specific dates to be applied to each cash flow and then they can be at irregular intervals. The function can exist very useful equally greenbacks flows are often unevenly spaced out, and this enhanced level of precision is required.

Internal Rate of Render (IRR) and NPV

The internal rate of render (IRR ) is the disbelieve rate at which the net present value of an investment is equal to zero. Put some other way, it is the chemical compound annual return an investor expects to earn (or actually earned) over the life of an investment.

For case, if a security offers a series of cash flows with an NPV of $fifty,000 and an investor pays exactly $50,000 for it, then the investor's NPV is $0. It ways they volition earn whatever the discount rate is on the security. Ideally, an investor would pay less than $50,000 and therefore earn an IRR that's greater than the discount charge per unit.

Typically, investors and managers of businesses await at both NPV and IRR in conjunction with other figures when making a decision. Learn about IRR vs. XIRR in Excel .

Negative vs. Positive Cyberspace Nowadays Value

If the cyberspace present value of a project or investment, is negative information technology means the expected rate of render that will be earned on it is less than the disbelieve rate (required rate of return or hurdle rate ). This doesn't necessarily hateful the project will "lose money." Information technology may very well generate accounting profit (net income), but since the charge per unit of return generated is less than the disbelieve rate, information technology is considered to destroy value. If the NPV is positive, it creates value.

Applications in Fiscal Modeling

NPV of a Business

To value a business, an analyst will build a detailed discounted cash flow DCF model in Excel. This fiscal model will include all revenues, expenses, upper-case letter costs, and details of the business.

Once the key assumptions are in place, the annotator can build a 5-twelvemonth forecast of the iii financial statements (income statement, residue sail, and greenbacks menstruation) and calculate the free cash catamenia of the firm (FCFF) , also known as the unlevered complimentary cash flow.

Finally, a final value is used to value the visitor beyond the forecast period, and all cash flows are discounted back to the present at the house's weighted boilerplate cost of capital. To learn more, check out CFI's free detailed fiscal modeling course.

NPV of a Project

To value a projection is typically more straightforward than an unabridged business. A similar arroyo is taken, where all the details of the project are modeled into Excel, however, the forecast period will be for the life of the project, and there will be no terminal value. Once the costless greenbacks menstruum is calculated, it tin can be discounted back to the present at either the business firm's WACC or the appropriate hurdle rate.

Drawbacks of Net Present Value

While cyberspace present value (NPV) is the nearly commonly used method for evaluating investment opportunities, it does have some drawbacks that should be carefully considered.

Key challenges to NPV analysis include:

- A long listing of assumptions has to be made

- Sensitive to small changes in assumptions and drivers

- Easily manipulated to produce the desired output

- May not capture 2nd- and third-order benefits/impacts (i.e., on other parts of a business organization)

- Assumes a abiding discount rate over fourth dimension

- Accurate take chances aligning is challenging to perform (difficult to get data on correlations, probabilities)

Additional Resources

Net Present Value (NPV) is the most detailed and widely used method for evaluating the attractiveness of an investment. Hopefully, this guide's been helpful in increasing your understanding of how information technology works, why it'southward used, and the pros/cons.

To continue advancing your career, check out these relevant resources:

- Guide to Financial Modeling

- Financial Modeling All-time Practices

- Advanced Excel Formulas

- All Valuation Manufactures

Source: https://corporatefinanceinstitute.com/resources/knowledge/valuation/net-present-value-npv/

0 Response to "When Reviewing the Net Present Value Profile for a Project"

Mag-post ng isang Komento